Amazon Seller Taxes: All You Need to Know

Download Amazon Seller Guide

This guide will help you get started, understand the basics of Amazon selling, and explain in simple words how it all works.

Taxes are one of the most confusing – and critical – parts of running an Amazon business. From understanding what counts as taxable income to managing sales tax in different states, sellers face a complex web of responsibilities.

Miss a form or overlook a rule, and you could end up with costly penalties or missed deductions. Whether you're just getting started or already generating six figures, this post walks you through everything you need to know about Amazon seller taxes. We'll cover income tax, sales tax, 1099-K forms, and more – so you can stay compliant, save money, and focus on growing your store.

Do Amazon Sellers Have to Pay Taxes?

.avif)

Yes – Amazon sellers are absolutely responsible for paying taxes. While Amazon may handle certain aspects, like collecting and remitting sales tax in states with marketplace facilitator laws, it doesn’t cover your full tax picture.

If you’re selling products for a profit, you’re likely running a business in the eyes of the IRS. That means you’re subject to federal income tax and potentially state income tax, as well as self-employment tax if you're not on a payroll. Even hobby sellers can trigger tax obligations if their activity is frequent or profit-driven.

Understanding what taxes apply to your situation is the first step to staying compliant and avoiding penalties down the road.

Types of taxes Amazon sellers must deal with

Amazon sellers may encounter multiple types of taxes depending on where they operate and how their business is structured. Here are the core categories you need to know.

Federal income tax

Sellers are required to report and pay income tax on their profits from selling on Amazon. The amount of tax owed will depend on the seller's total income and tax bracket.

You must report all profit earned through your Amazon business. This applies even if you don’t receive a 1099-K. Taxable income includes your total sales revenue minus allowable business expenses.

State income tax

If your state has an income tax, you’ll likely need to file and pay here too – even for income earned online.

Self-employment tax

As an individual seller or single-member LLC, you’re responsible for both the employer and employee portion of Social Security and Medicare taxes. Currently, that’s 15.3% on net earnings.

Sales tax

You may be required to collect and remit sales tax in states where you have nexus. In most states, Amazon does this for you – but not always. You still need to register and file in some jurisdictions. The sales tax rate depends on the state and ranges from 0% to 13% for each transaction.

Excise tax (less common)

Applies to specific product types like alcohol, tobacco, or fuel-related goods. Most Amazon sellers won’t encounter this, but it’s critical to know if you sell regulated items.

International taxes

Sellers who sell internationally may be subject to additional taxes, such as value-added tax (VAT) or goods and services tax (GST), depending on the country they sell to.

Key U.S. tax filing deadlines for Amazon sellers in 2025

In the U.S., businesses such as partnerships, S corporations, and LLCs must file taxes by specific dates. Mark these important 2025 tax deadlines on your calendar.

- March 17, 2025 – Deadline to file Partnership (Form 1065) and S-Corporation (Form 1120-S) returns.

- March 31, 2025 – Due date for submitting 1099 forms with Form 1096 (if filing electronically).

- April 15, 2025 – Deadline for both Individual Income Tax Returns and C-Corporation Tax Returns (Form 1120).

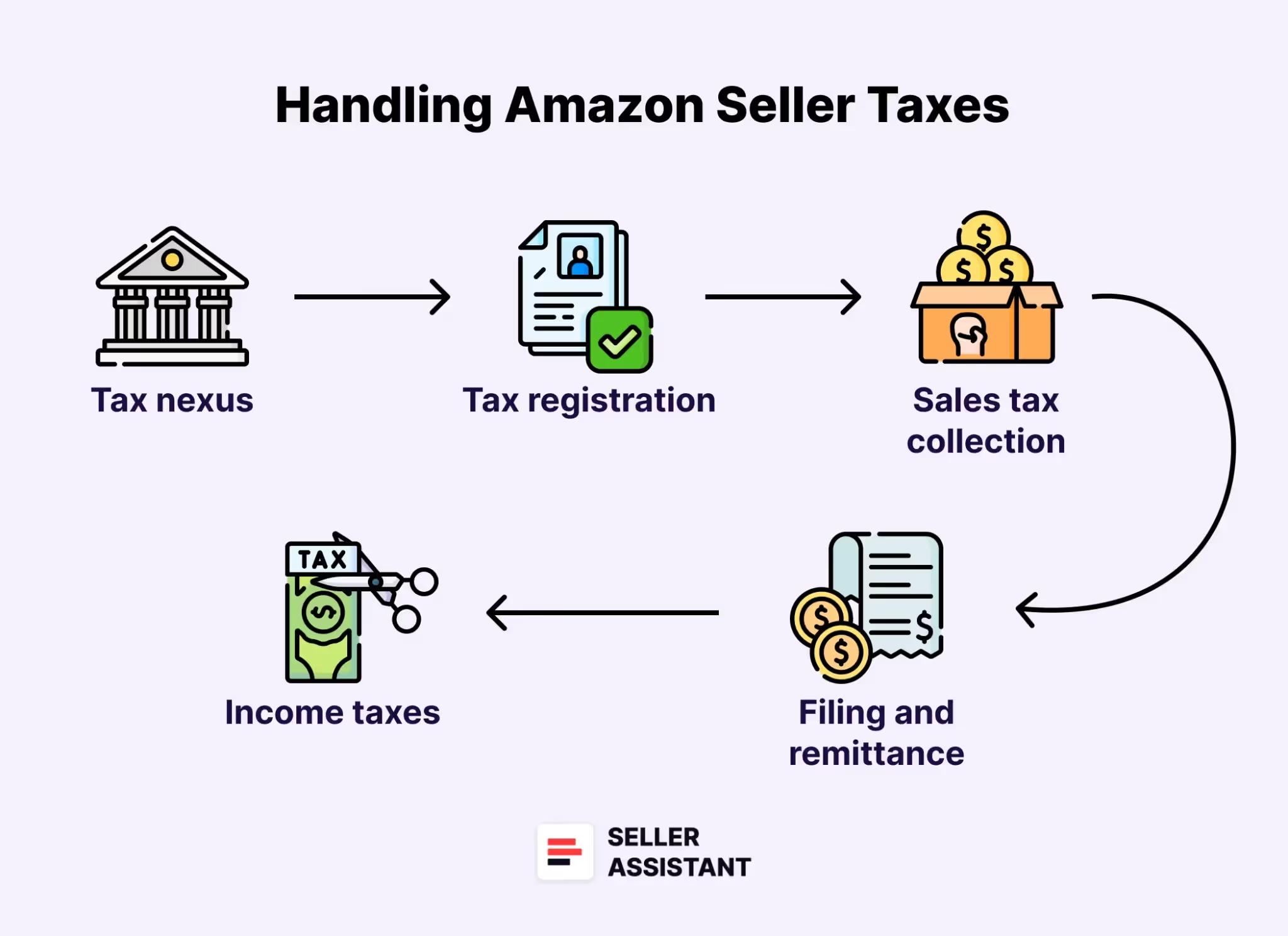

How to Handle Amazon Seller Taxes

Managing taxes as an Amazon seller isn’t just a one-time task – it’s an ongoing process that affects every sale you make. Between sales tax obligations, income tax filings, and business expense tracking, staying compliant takes organization and awareness. Here's a complete breakdown of what you need to know and do.

Sales tax collection

Amazon sellers are responsible for collecting sales tax from buyers in states where they have sales tax nexus – a significant business presence like a warehouse, office, or employees.

Tax nexus and marketplace facilitator laws

Most U.S. states now enforce marketplace facilitator laws, which require platforms like Amazon to collect and remit sales tax on your behalf. This simplifies compliance in those states – but not everywhere. You may still need to register and file in states where Amazon does not handle tax collection or where you have additional nexus through other sales channels (e.g., Shopify, Walmart).

Sales tax registration

In any state where you have nexus and Amazon isn’t handling tax for you, you must:

- Register for a sales tax permit before collecting tax.

- Display your tax registration number as required by state law.

Filing and remittance

Sales tax filing requirements vary by state and depend on your sales volume. Some states require monthly, quarterly, or annual filings. Even if Amazon collects tax for you, some states still require you to file a “zero return” or report those transactions.

Income taxes

Beyond sales tax, you must report income from Amazon sales on your federal and possibly state income tax return. This includes:

- Gross revenue from sales.

- Deductible business expenses like cost of goods sold, shipping, packaging, tools, software subscriptions, advertising, and home office use.

- Making quarterly estimated tax payments if you expect to owe $1,000 or more in taxes for the year.

Self-employment tax

Most sellers are considered self-employed. This means you must pay both the employer and employee portions of Medicare and Social Security (15.3% combined) unless you’re on payroll under an S-Corp setup.

Additional considerations Amazon sellers should know

Multi-channel sales

If you sell on platforms besides Amazon, like Etsy or Shopify, you may have separate sales tax and income reporting obligations that Amazon won’t cover.

Entity structure

Choosing the right business structure – sole proprietorship, LLC, or S-Corp – can impact how you're taxed and how much you pay. Consider working with a tax advisor to choose the setup that best supports your financial goals.

Bookkeeping and expense tracking

Use accounting software (like QuickBooks, Xero, or A2X) or hire a professional to keep accurate records of revenue and expenses. Poor records lead to overpaying tax or triggering audits.

How to Handle Income Tax as an Amazon Seller

Selling on Amazon may feel like a side hustle or a digital storefront, but in the eyes of the IRS, it’s a business – and your income is taxable. Here's what you need to know to stay compliant and avoid underpayment penalties.

Report all Amazon income

All revenue from Amazon must be reported, even if you don’t receive a Form 1099-K. Income is generally reported on:

- Schedule C (for sole proprietors or single-member LLCs)

- Form 1065 or 1120-S (for partnerships or S-Corps)

Amazon only issues 1099-K if you exceed the IRS threshold ($600 in gross payments in 2025). But regardless, you must report your total gross receipts.

Amazon seller income tax documents

Amazon Seller Central provides a Tax Document Library where you can access all the necessary tax documents for Amazon sellers. These documents are available for download based on your eligibility.

It's important to verify their accuracy to ensure compliance with IRS requirements. If you opt out of electronic delivery, Amazon will send these documents to you via postal mail.

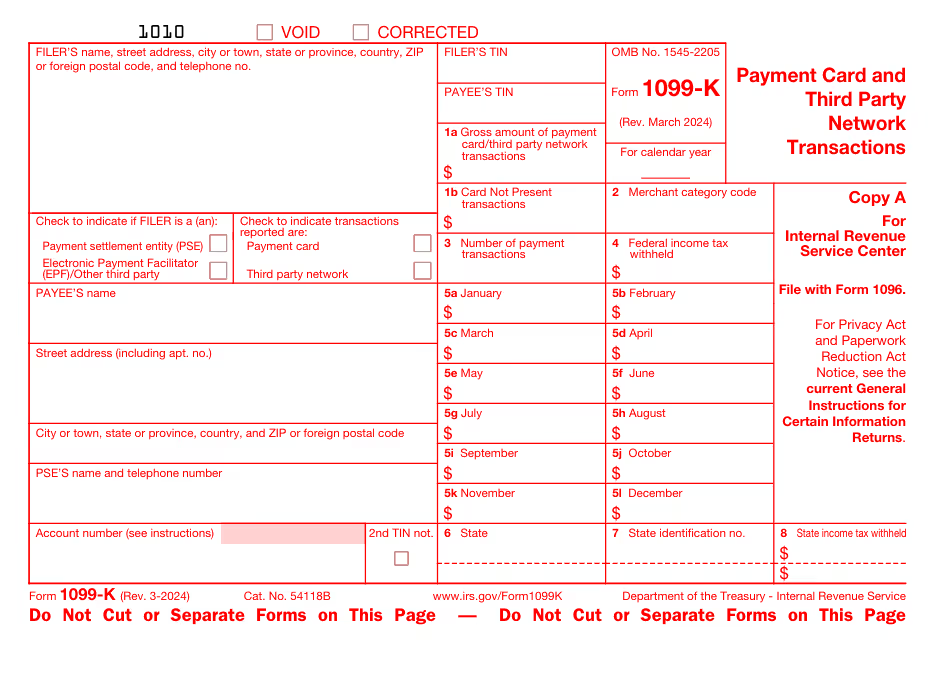

Form 1099-K

Form 1099-K is issued by Amazon to report your annual and monthly gross sales to the IRS, including sales tax and shipping fees.

This form is prepared for sellers who meet specific criteria: in 2025, sellers must report payments on Form 1099-K when the total amount of payments received for goods or services is more than $2,500 and there's no transaction threshold. You can upload your tax information directly in Seller Central.

If you qualify for a 1099-K, you'll likely receive a notification via email. You can find and download this form from the Tax Document Library in Seller Central by selecting the 'Reports' menu.

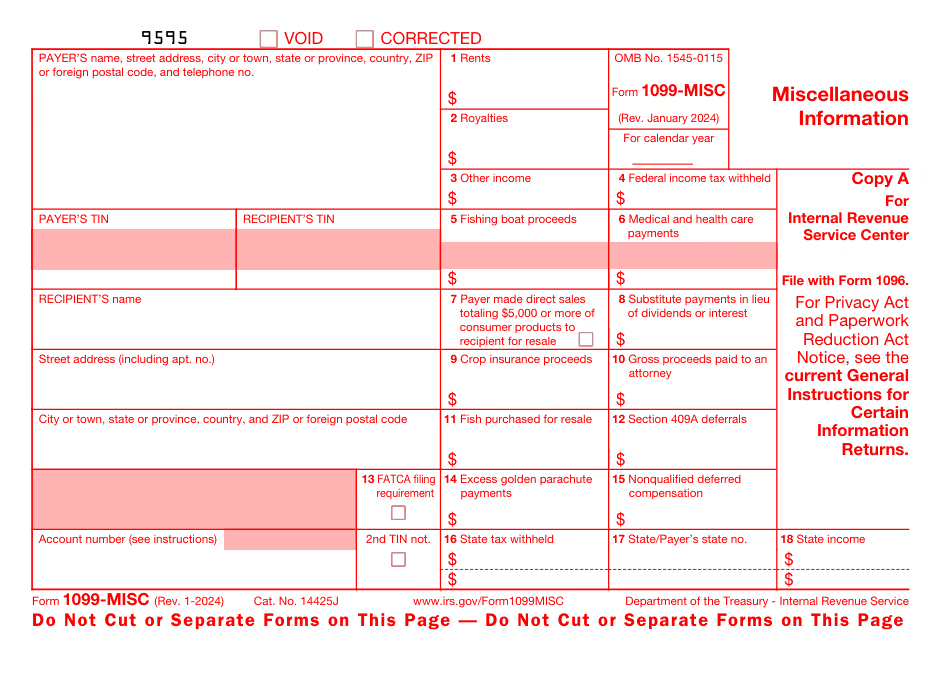

Form 1099-MISC

Form 1099-MISC may also be necessary for some U.S. sellers to report other income, such as commissions from Amazon sales.

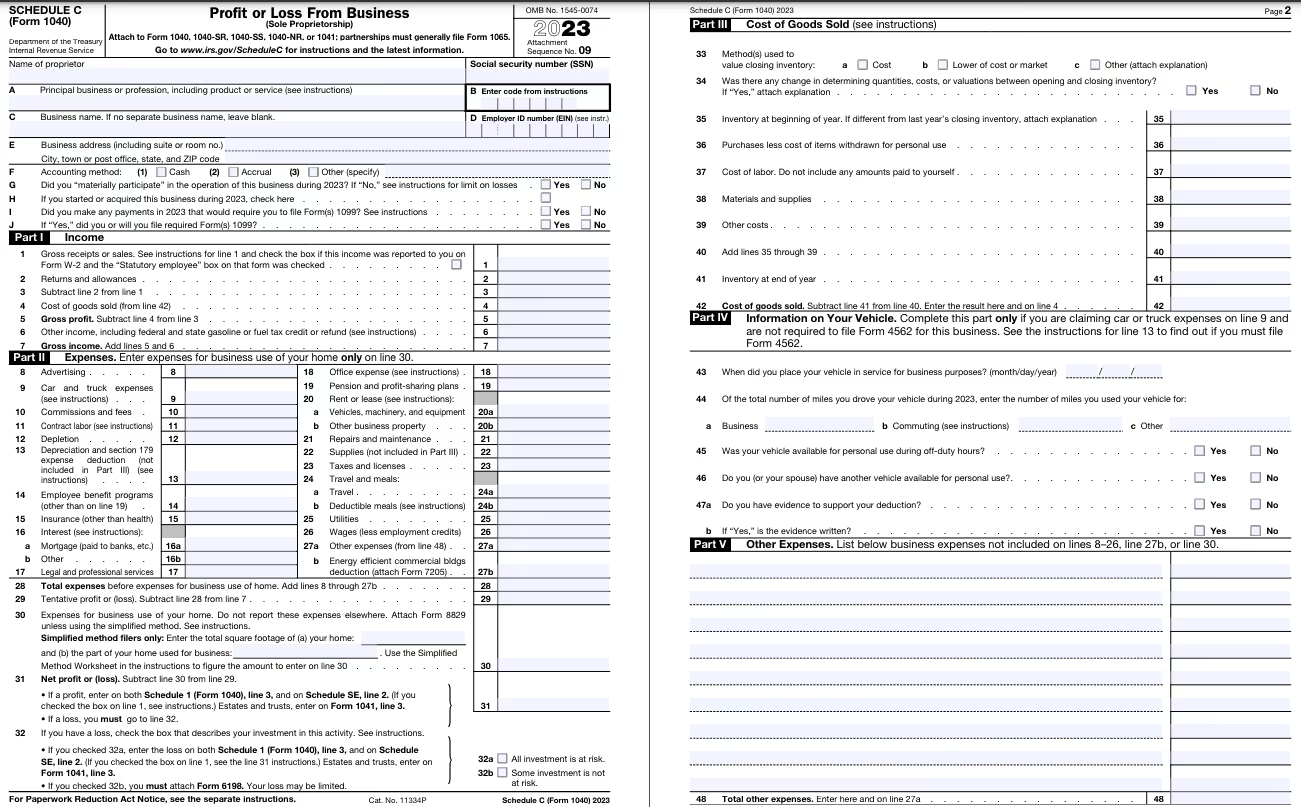

Schedule C (Form 1040)

Schedule C (Form 1040) is used by individuals to file federal income taxes. These forms report your gross income and taxable amount after deductions and credits. Even if you don’t have a business license, which depends on state laws, you might still need to use these forms. Forming an LLC can offer personal liability protection and tax advantages through deductions.

Forms 1120 and 1120S

Form 1120 and 1120S are used by C corporations and S corporations respectively, along with Form K-1 for reporting personal income on individual tax returns.

Form 1065

Form 1065 is for partnerships, requiring Forms K-2 or K-3 to report individual shares of business profits on personal tax returns.

Track and deduct business expenses

You can reduce your taxable income by deducting legitimate business expenses, such as:

- Cost of Goods Sold (COGS)

- FBA and referral fees

- Shipping supplies and postage

- Home office and internet costs (if used for your business)

- Advertising and marketing tools

- Product sourcing or other seller software.

Keep detailed, dated records and receipts for all deductible expenses.

Pay self-employment tax

If you're not on payroll, you’re self-employed and must pay:

- Self-employment tax (15.3%) for Social Security and Medicare.

- Federal income tax based on your total net income.

- Use Schedule SE with your return to calculate this.

Make quarterly estimated payments

The IRS requires you to pay taxes as you earn. If you expect to owe more than $1,000 in taxes for the year, you must make quarterly estimated tax payments.

2025 deadlines:

- April 15 (Q1)

- June 16 (Q2)

- September 15 (Q3)

- January 15, 2026 (Q4 for 2025)

Failing to pay on time can result in penalties and interest – even if you pay in full at year-end.

Choose the right business structure

How you're taxed depends on how your business is structured:

- Sole Proprietor or Single-Member LLC – taxed as personal income on Schedule C.

- Multi-Member LLC or Partnership – taxed via Form 1065, with each member receiving a K-1.

- S-Corporation – can offer self-employment tax savings but adds administrative complexity.

Consult a tax professional to weigh benefits and costs based on your profit level.

How to Handle Sales Tax on Amazon?

As an Amazon seller, you are responsible for collecting and remitting sales tax on eligible orders. The process of handling sales tax on Amazon can vary based on several factors, including the location of your business and where you sell your products.

How does sales tax work on Amazon?

Typically, sales tax is collected by Amazon on behalf of sellers for the taxable products sold on the platform. The amount of sales tax that must be collected depends on the location of the buyer and the seller and the type of product being sold.

However, sellers may be required to collect and remit sales tax in states where Amazon does not collect sales tax on their behalf. That may apply depending on the kind of items they sell and where they have a sales tax nexus.

If you sell on multiple platforms, you're on the hook for tax in any state where you’ve triggered nexus via those channels.

Understanding sales tax nexus

Sales tax nexus is the legal connection between your business and a state that obligates you to collect and remit sales tax there. If you have nexus in a state, you’re required to register for a sales tax permit and start collecting tax from buyers in that state – even if you’re selling through Amazon.

There are two main types of nexus Amazon sellers need to watch for:

- Physical nexus

- You create a physical presence – and thus nexus – if you:

- Store inventory in a state (e.g., Amazon FBA warehouses).

- Have an office, warehouse, or physical location.

- Employ staff or contractors in that state.

- Because Amazon redistributes FBA inventory across fulfillment centers, many sellers unknowingly establish nexus in multiple states.

- Economic nexus

- Even without a physical presence, some states establish a nexus based on your sales volume or transaction count within the state. For example:

- If you sell more than $100,000 or have 200+ transactions to customers in a given state annually, you may trigger economic nexus (thresholds vary by state).

How to collect sales tax on Amazon?

As an Amazon seller, it's your responsibility to collect and remit sales tax for orders shipped to buyers in states where you have a tax obligation.

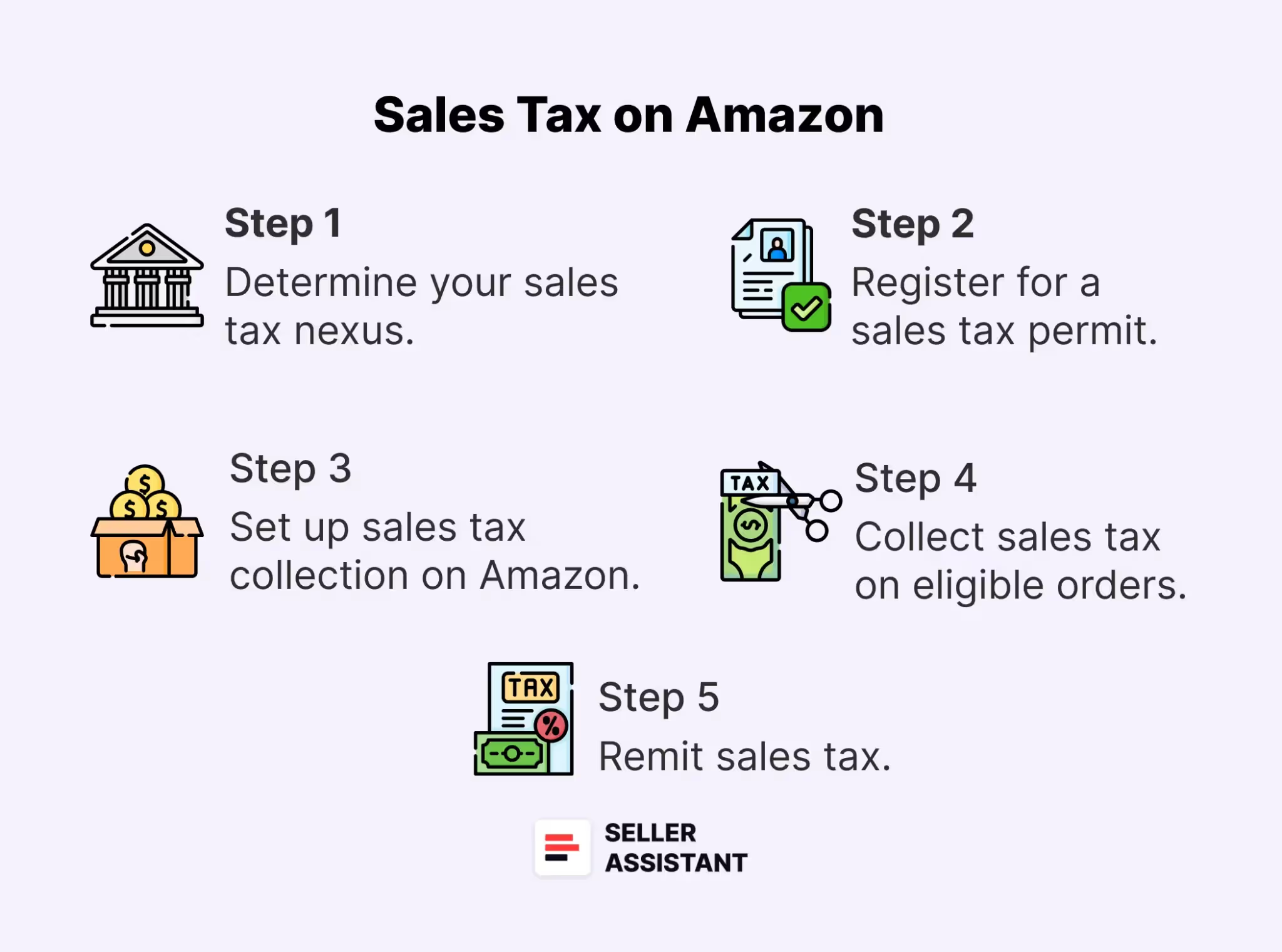

Collecting sales tax on Amazon step-by-step

Step 1. Determine your sales tax nexus

The sales tax nexus is the connection between your business and a state that requires you to collect sales tax. You must determine if you have a sales tax nexus in any state where you sell your products. That can include where your business is located, where your products are stored, and where your customers are located.

Step 2. Register for a sales tax permit

Once you determine where you have a sales tax nexus, you must register for a sales tax permit in each state. That will allow you to collect and remit sales tax legally.

Step 3. Set up sales tax collection on Amazon

You can set up sales tax collection by going to your Seller Central account and navigating to the Tax Settings page. You must enter your sales tax permit information for each state where you have a nexus.

Step 4. Collect sales tax on eligible orders

Amazon will automatically calculate and collect sales tax on eligible orders based on the customer's location and the products sold. You must ensure you are charging the correct rate for each state.

Step 5. Remit sales tax

You must regularly remit your collected sales tax to each state. The frequency of remittance varies by state, so be sure to check the requirements for each state where you have a nexus.

How to calculate sales tax for Amazon deals?

When you do product research, you must calculate how much you can earn with your Amazon product, and accurately account for your taxes. You must consider this expense to ensure you are profitable and at which level.

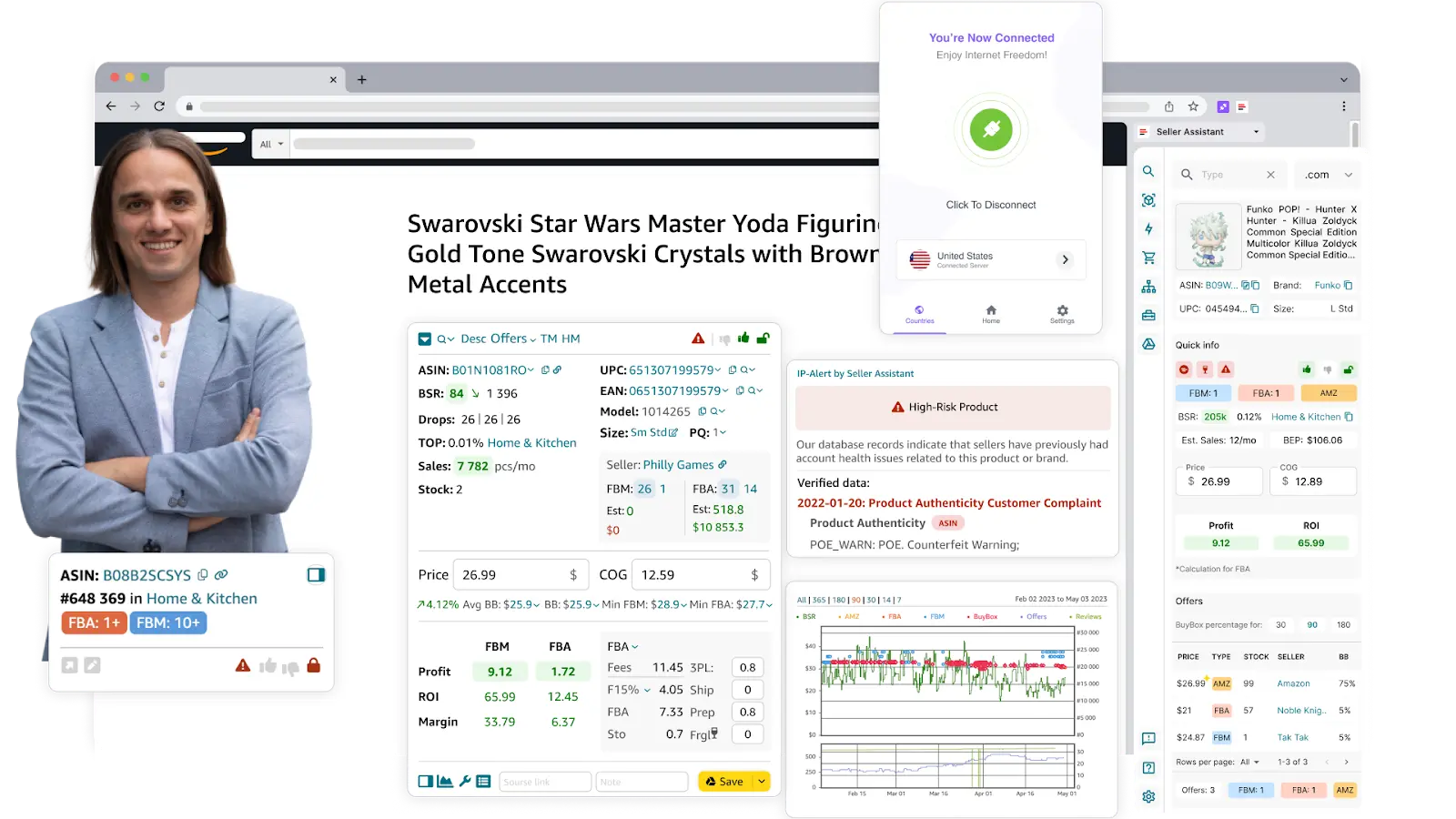

Seller Assistant allows you to easily calculate Amazon fees both in bulk (if you have a supplier list with thousands of UPCs) and for individual products directly on Amazon and supplier pages, side-by-side with real-time profitability estimates.

Note. Seller Assistant is a comprehensive product-sourcing software that helps Amazon sellers quickly find high-profit deals. It combines three extensions: Seller Assistant Browser Extension, and IP-Alert Chrome Extension by Seller Assistant, and VPN by Seller Assistant, Amazon seller tools: Price List Analyzer, Brand Analyzer, Seller Spy, Bulk Restrictions Checker, and API integrations, and features: Storefront Widget, Side Panel View, FBM&FBA Profit Calculator, Quick View, Stock Checker, IP Alert, Variation Viewer, Sales Estimator, Offers, and Restrictions Checker.

It offers a robust toolkit of over 20 features built to streamline every part of the sourcing process – from bulk scanning wholesale supplier sheets for high-margin leads to deep product research and advanced brand and competitor analysis. By using this FBA and FBM product sourcing software, you can easily identify products that have the potential to be sold well on Amazon.

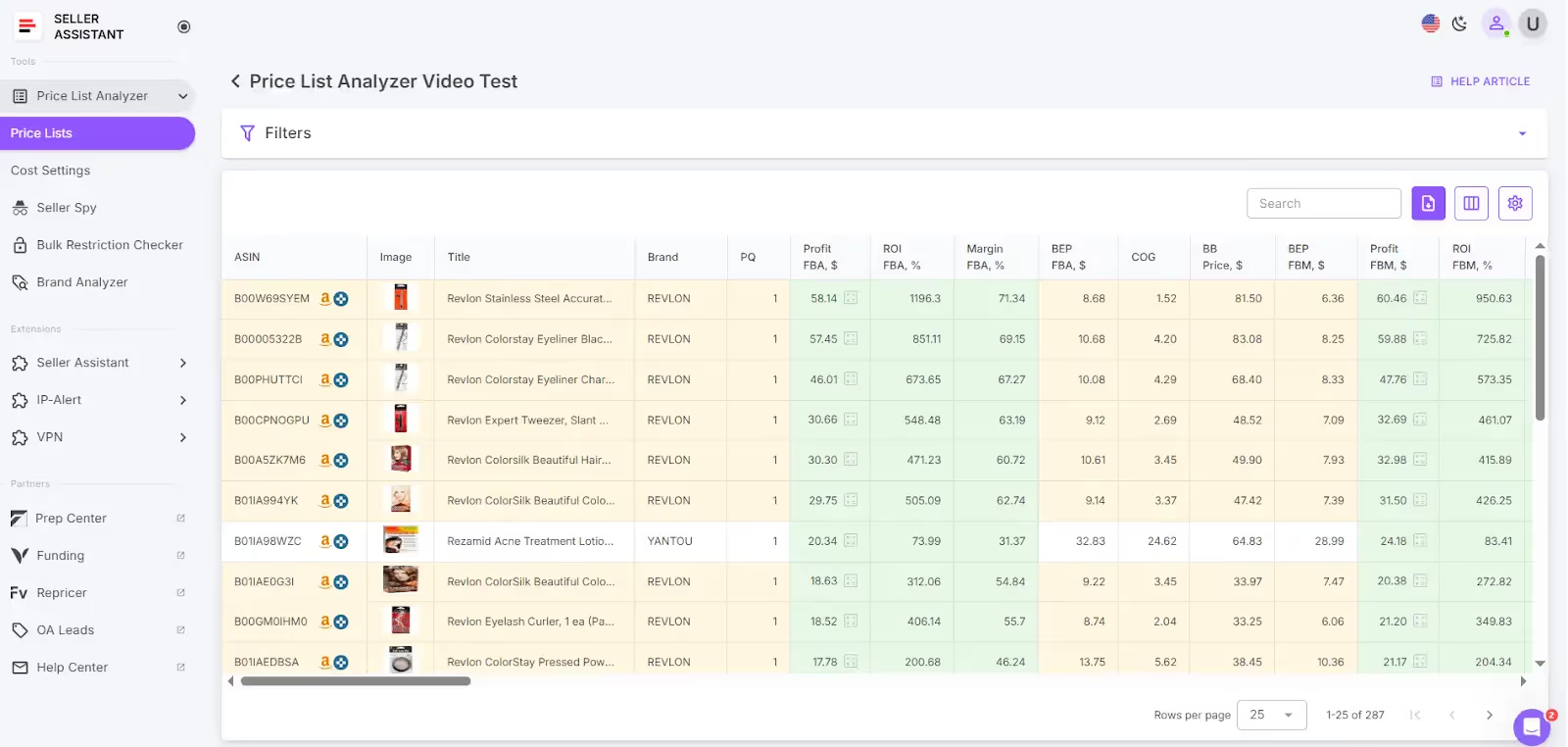

Sales tax calculation in bulk

If you're working with a wholesale sheet or supplier price list packed with hundreds of UPCs, Seller Assistant's Price List Analyzer helps you cut through the noise. Designed for wholesale, online arbitrage (OA), and dropshipping sellers, it quickly surfaces profitable opportunities and flags high-risk products.

The tool automatically displays key product data – like ROI, margin, profit, Amazon FBA fees, sales rank, competition, and pricing trends – all in one place.

It explicitly shows sales tax and percentage you apply. You’ll instantly see whether a product is worth sourcing, saving you hours of manual research and helping you avoid costly sourcing mistakes. Simply upload your wholesale list in Excel format and get you sales tax.

Sales tax calculation for single products

For quick, accurate profit analysis, including sales tax calculation, Amazon sellers rely on the Seller Assistant Extension. It works right on Amazon product and search pages, and on supplier websites, instantly calculating fees, margins, and net profit – no tab switching or manual data entry required.

Seller Assistant is a comprehensive product sourcing software that calculates sales tax if applicable. To calculate it, enter COG, click it, and switch the “Tax” toggle in the pop-up. Seller Assistant will calculate your tax.

Can I Sell on Amazon Tax-Free?

If you purchase products with the intent to resell them – whether on Amazon or another platform – you may qualify for sales tax exemption on those purchases. This process is legal and widely used by e-commerce businesses to avoid paying tax twice: once when buying inventory, and again when selling it to customers.

If you are based in a state that does not have a sales tax (such as Alaska, Delaware, Montana, New Hampshire, and Oregon), they may not be required to collect sales tax on the transaction.

Example

If you live in Texas and plan to resell phone cases on Amazon, you can present your Texas resale certificate to a wholesale distributor to avoid paying sales tax at checkout.

However, sales tax laws can be complex and vary by state, so sellers should consult a tax professional to ensure they comply with all relevant tax laws. Additionally, sellers may be required to collect and remit sales tax in states where they have a physical presence, such as a warehouse or storefront.

What is a resale certificate?

A resale certificate (sometimes called a reseller's permit, sales tax exemption certificate, or resale license) is a state-issued document that proves you are a registered seller buying goods strictly for resale – not for personal or business use.

This certificate allows you to buy inventory without paying sales tax to your supplier.

How to get a resale certificate

The process varies by state, but generally follows these steps.

Step 1. Register for a Sales Tax Permit

Before you can apply for a resale certificate, you must first register your business for a sales tax permit (also called a seller’s permit or tax ID) in your home state.

- Visit your state’s Department of Revenue or Taxation website.

- Fill out the application online or download the form.

- You'll need basic business information like:

- Your EIN (Employer Identification Number) or SSN

- Business name and address

- Business activity type (e.g., e-commerce retail)

- After approval, you’ll receive a sales tax number – this is required for your resale certificate.

Step 2. Complete the Resale Certificate Form

- Each state has its own resale certificate form. You’ll typically fill in:

- Your sales tax number (from Step 1)

- The legal name of your business

- A brief description of the products you’re buying for resale (e.g., electronics, home goods, apparel)

- Some states accept the Uniform Sales & Use Tax Certificate, especially for multi-state sellers. Always verify with the supplier which forms they accept.

- If your supplier is in a different state than you, you may need to provide a certificate that’s valid in their state too.

- Step 3. Submit the certificate to your supplier

Once your resale certificate is completed and signed:

- Provide a copy to each wholesale supplier, distributor, or vendor you buy inventory from.

- Some suppliers may require a new form each year; others keep it on file indefinitely.

International Amazon Seller Taxes

If you sell on Amazon with Amazon Global Selling, you must pay various taxes in different tax jurisdictions. Keep in mind that some countries have tax treaties to avoid double taxation of income earned internationally. Sellers should consult with a tax professional to understand if tax treaty benefits apply to their situation, which could reduce their tax burden.

Here's an overview of how international taxes work for Amazon sellers.

Value-Added Tax (VAT)

In many countries, especially in Europe, sellers need to charge VAT on goods sold to customers in VAT-applicable countries. The rate of VAT varies by country and sometimes by product type. Sellers must register for VAT in each country where they have a tax liability.

Goods and Services Tax (GST)

Similar to VAT, countries like Australia, Canada, and India implement a GST system. The requirements for GST registration and filing are similar to those for VAT, including needing to register once certain thresholds are crossed.

Customs duties and import taxes

When shipping goods internationally, customs duties and import taxes may apply depending on the destination country. The responsibility for these charges can vary based on the Incoterms (delivery terms) agreed upon in the sale. Amazon can sometimes handle this for sellers using specific programs like Amazon Global Selling.

How to calculate VAT?

If you sell on international marketplaces, you must calculate how much VAT you will pay to make sure you will get a profit from the product you sell.

To do that quickly, you can use Seller Assistant. To calculate VAT, you can select your VAT scheme. If you source from retail suppliers, choose COG, incl. VAT and enter prices from the supplier's website for your calculations (this price typically includes VAT). If you source from a wholesale supplier, choose COG excluding VAT (this price typically excludes VAT).

To calculate VAT with Seller Assistant’s FBM&FBA Profit Calculator, enter COG, click it, and switch the “VAT” toggle in the pop-up. Seller Assistant will calculate your VAT.

Seller Assistant supports VAT calculation and European VAT. You can select your VAT scheme – no VAT, standard VAT rate, reduced VAT rate, non-registered VAT for UK sellers, and VAT on fees for European sellers who sell on Amazon US or Canada. Incoming VAT for the cost of goods is supported.

Common Tax Mistakes Amazon Sellers Make

Taxes can feel like the least exciting part of running an Amazon business – but mistakes here can be costly. Whether you're new to e-commerce or scaling fast, here are the most common pitfalls sellers run into – and how to avoid them:

Ignoring sales tax nexus

Many sellers overlook where their inventory is stored or where they’ve triggered economic nexus. Failing to register and file in those states can result in penalties or audits – especially if you sell through multiple channels.

Fix: Use tools to monitor nexus obligations and track warehouse locations.

Assuming Amazon handles all taxes

Yes, Amazon collects and remits sales tax in most states – but not everywhere, and only for Amazon sales. If you sell on other platforms or run external ads with checkout links, you may still be on the hook.

Fix: Check which states have marketplace facilitator laws and ensure you're filing any required zero-return sales tax forms.

Mixing personal and business expenses

Blurring the line between business and personal finances leads to messy books and limited deductions.

Fix: Open a dedicated business bank account and credit card. Track all business expenses separately from day one.

Missing estimated tax payments

Many sellers forget that they must pay taxes quarterly. Waiting until April means you could owe penalties – even if you pay in full.

Fix: Set calendar reminders for the quarterly IRS deadlines and work with a tax pro or accounting tool to estimate payments based on your profit.

Not tracking inventory properly

Incorrect COGS (Cost of Goods Sold) figures can massively distort your taxable income.

Fix: Use inventory tracking tools or accounting software that supports FBA reconciliation and matches payouts accurately.

Overlooking deductions

Sellers often miss out on legit write-offs like packaging supplies, shipping software, home office expenses, and mileage.

Fix: Keep detailed receipts and categorize expenses using tools like QuickBooks or Xero.

DIY Taxes with no e-commerce experience

General accountants may not understand Amazon-specific issues like 1099-K reconciliation, FBA fees, or product cost mapping.

Fix: Hire an accountant who specializes in e-commerce and is familiar with Amazon's reporting quirks.

Final Thoughts

In conclusion, taxes don’t have to be overwhelming—especially when you understand how they work and have the right tools in place. From collecting sales tax in the right states to accurately reporting income and tracking expenses, staying compliant as an Amazon seller is entirely doable with a bit of upfront effort and ongoing organization.

One commonly overlooked mistake? Ignoring sales tax when calculating profitability. If you’re buying and selling products across different states, those tax differences can significantly impact your bottom line. Tools like Seller Assistant help factor in Amazon FBA fees and sales tax obligations, giving you an accurate, real-time view of whether a product is truly worth sourcing.

Seller Assistant is an all-in-one product sourcing software offering all the features vital for product sourcing. It combines three extensions: Seller Assistant Extension, IP Alert, and VPN by Seller Assistant, tools: Price List Analyzer, Brand Analyzer, Seller Spy, Bulk Restrictions Checker, and API integrations, and features: Storefront Widget, Side Panel View, FBM&FBA Profit Calculator, Quick View, Stock Checker, IP Alert, Variation Viewer, Sales Estimator, Offers, Restrictions Checker, and other features that help quickly find high-profit deals. Seller Assistant also offers integration with Zapier allowing to create custom product sourcing workflows.

.svg)