Amazon Seller Insurance: All You Need To Know

Download Amazon Seller Guide

This guide will help you get started, understand the basics of Amazon selling, and explain in simple words how it all works.

As an Amazon seller, your business success depends on your ability to manage risks effectively. The risks associated with selling on Amazon can be overwhelming, whether it's potential product liability, inventory loss, or third-party claims.

That's why it's essential to have adequate insurance coverage to protect your business from unexpected events that can lead to financial losses.

This post will discuss Amazon seller insurance and why it's crucial for sellers whose sales exceed $10,000. We'll explore the insurance requirements, its benefits, and some tips for getting insurance for your business through Amazon.

Who Must Have Insurance on Amazon?

As a seller, it is mandatory for you to have commercial liability insurance if your gross proceeds in sales on Amazon exceed $10,000 in a month or if you are requested to do so, as per Amazon Services Business Solutions Agreement. You must get insurance within 30 days after exceeding the threshold.

Product liability insurance provides protection in case someone gets hurt or property gets damaged because of a defect in your product's design or malfunction. With this type of insurance, your provider will cover the compensation or damages you're legally responsible for up to your policy limit. Additionally, your insurance company will cover the legal expenses associated with a customer lawsuit.

On Amazon, it is up to you to decide which type of insurance you would like to purchase, whether commercial general, excess, or umbrella liability insurance. However, the policy you choose must cover all of the products you have listed for sale on Amazon.

Related: Seller Assistant App Extension Review

Seller Assistant App — the Ultimate Tool for Amazon Online Arbitrage

How to Dropship on Amazon with Seller Assistant App

Amazon Insurance Requirements

For your commercial liability insurance policy to be accepted by Amazon, it needs to meet the following requirements:

- Your policy should cover all liabilities caused by your business, including bodily injury and any products or completed operations, and the total coverage should be at least $1 million per occurrence.

- You can choose commercial general, umbrella, or excess liability insurance for your policy, but it must be written on an occurrence basis.

- Your insurance provider must be able to handle claims globally, and they should have an excellent financial rating, which is either S&P A- or AM Best A-. If these ratings aren't available, an equivalent rating from your country is acceptable.

- Your insurance provider should inform Amazon at least 30 days in advance if they cancel, modify or non-renew your policy.

- Your policy should include Amazon and its affiliates and assignees as additional insureds.

- Any deductible for your policy should be $10,000 or less and listed in the certificate(s) of insurance.

- The policy should cover all sales made through products you listed on the Amazon website.

- Your insured name should match the legal entity name you provided to Amazon. You can see this name on your Account Info page.

- You must complete and sign the policy.

- The policy should be valid for at least 60 days from when you submit it.

You can find these requirements on your Seller Central Help page in Program Policy > Pro Merchant Insurance Requirements.

Related: Customer Service by Amazon: All You Need to Know

Amazon Seller Compliance Documents

Top Amazon Product Categories

Amazon Insurance Benefits

Amazon insurance provides peace of mind and protection for sellers operating on the platform. It offers several benefits described below.

Protection against potential liabilities

Amazon's insurance program helps protect sellers from potential liabilities arising from their business operations on Amazon's platform. That includes coverage for property damage, bodily injury, and product liability claims.

Amazon pays valid claims

Amazon will pay valid claims that are less than $1,000 without seeking reimbursement from the seller having insurance. That means the seller does not have to pay out of pocket for small claims, which can be a significant financial burden for some sellers.

No need for separate insurance

Amazon's insurance Insurance Accelerator program eliminates the need for sellers to buy additional insurance, which can be time-consuming and expensive.

Insurance coverage on and off Amazon

Some policies of the insurance program cover products sold by the seller on Amazon's platform and products sold outside of the platform, as long as they are related to the seller's Amazon business.

Affordable rates

Amazon's Insurance Accelerator program simplifies buying insurance at affordable rates for sellers, making it a cost-effective way to protect their business.

Related: What is the Amazon Buyer-Seller Messaging Service?

What Is Amazon Seller ID? How to Find Seller ID on Amazon

How to Get Insurance on Amazon?

Amazon provides a solution for sellers who need insurance quickly through its Amazon Insurance Accelerator program.

What is Amazon Insurance Accelerator?

Amazon Insurance Accelerator program connects sellers with Amazon's network of approved insurance providers who will assess the seller's qualifications and provide liability insurance at competitive rates. The program aims to streamline the process of obtaining product liability insurance for sellers who sell on Amazon.

Through the accelerator, US-based Amazon sellers gain access to quotes and the ability to purchase insurance policies tailored to their specific business requirements. The participating insurers automatically meet Amazon's criteria, eliminating the need for sellers to individually evaluate insurers or scrutinize policy details for potential hidden clauses.

Noteworthy insurers in the program are Harborway Insurance, which operates under Spinnaker Insurance Co., along with Chubb, Travelers, Liberty Mutual Insurance, Hiscox, and Markel. These companies have committed to providing digital policy options through NEXT Insurance, Simply Business, Inc., and Bold Penguin.

Related: Amazon Seller Identity Verification

Do You Need a Business License to Sell on Amazon?

What is the Amazon Request a Review Button?

How much does Amazon insurance cost?

As a rule, you will need product liability insurance to sell on Amazon. Therefore, your quote will depend on your estimated annual revenue. Rates can vary widely but generally fall within the range of 0.25% to 1% of revenue. The average cost is typically between $500 and $2,000 per year.

How to Upload Insurance to Amazon?

You must upload your Certificate of Insurance to Seller Central as soon as you get insurance. Follow the steps below to upload your insurance documents to Amazon Seller Central.

Related: How to Handle Negative Reviews on Amazon

What Are the Funding Options for Amazon Sellers?

Best Tax Software for Amazon Sellers

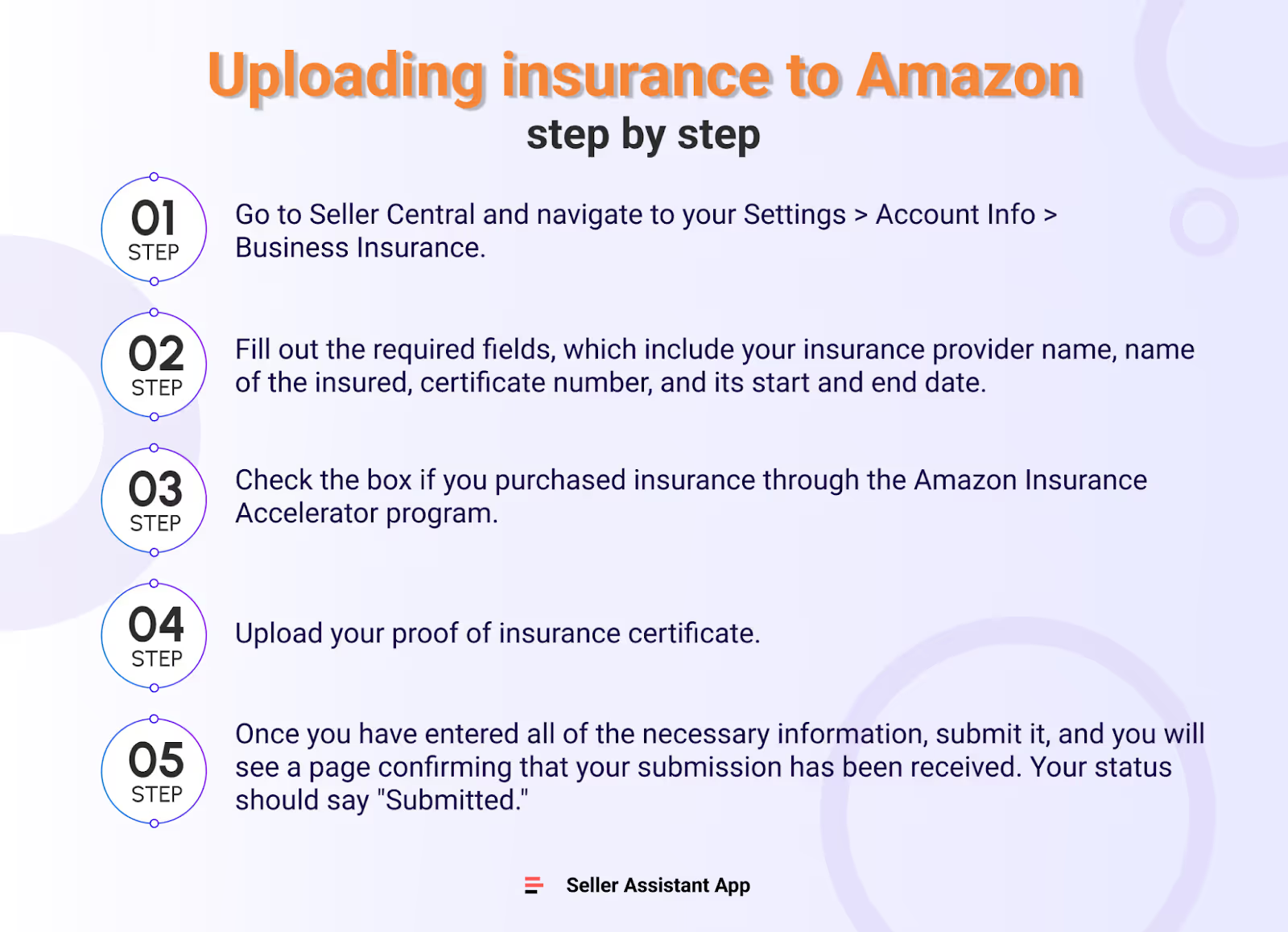

Uploading insurance to Amazon step by step

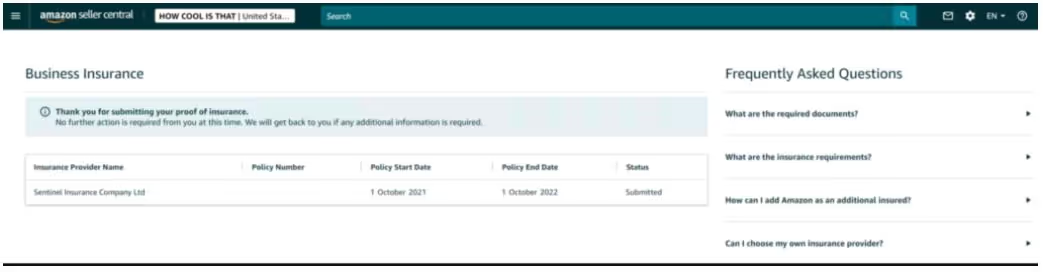

- Step 1. Go to Seller Central and navigate to your Settings > Account Info > Business Insurance. You'll see a list of business insurance providers on the business insurance page in your Amazon Seller Central.

- Step 2. Fill out the required fields, which include your insurance provider name, name of the insured (which must match the legal entity name of your Amazon account page), certificate number, and its start and end date.

- Step 3. Check the box if you purchased insurance through the Amazon Insurance Accelerator program.

- Step 4. Upload your proof of insurance certificate.

- Step 5. Once you have entered all of the necessary information, submit it, and you will see a page confirming that your submission has been received. Your status should say "Submitted."

Your certificate of insurance will be reviewed, and you will receive an email from Amazon stating the status of your submission. Ideally, the email will indicate that no further action is required, which means your request has been approved.

Related: FBA vs FBM: Which is Better for Amazon Sellers?

Amazon Seller Fulfilled Prime - Complete Guide

A dozen ways to find suppliers for reselling on Amazon.com and a checklist to verify them

Amazon Return Policy for Sellers - All You Need To Know

Final Thoughts

Amazon Insurance provides a valuable solution for sellers who are required to get insurance coverage while selling on Amazon's platform. With Amazon's Insurance Accelerator program, sellers can protect themselves against potential liabilities and obtain coverage for their products at competitive rates. The process of getting insurance is straightforward and can be completed quickly through Seller Central. By taking advantage of Amazon's Insurance Accelerator program, sellers can have peace of mind and focus on growing their business without worrying about potential liabilities.

However, researching profitable products is equally essential to ensure your business growth. Seller Assistant Аpp will effectively and reliably help you with this task. This all-in-one extension incorporates all features vital for product research. Seller Assistant App shows you the product’s profit, margin, and ROI. It also helps you immediately see if a product has any sales restrictions or has previously triggered problems with account health. It combines an FBM&FBA profit calculator, Quick View, UPC/EAN to ASIN converter, ASIN Grabber, Stock Checker, and Restrictions Checker in one tool.

.svg)